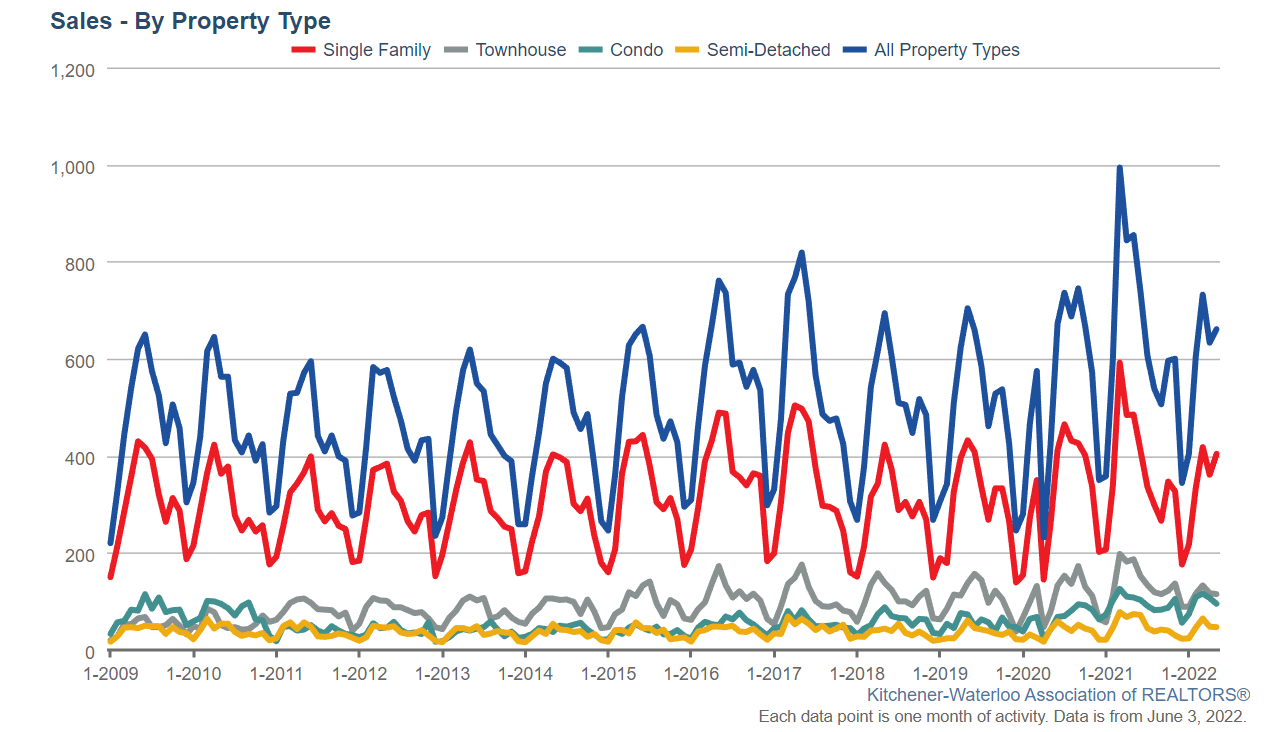

Last month’s home sales in Kitchener-Waterloo represented a decrease of 22.7 percent compared to May 2021.

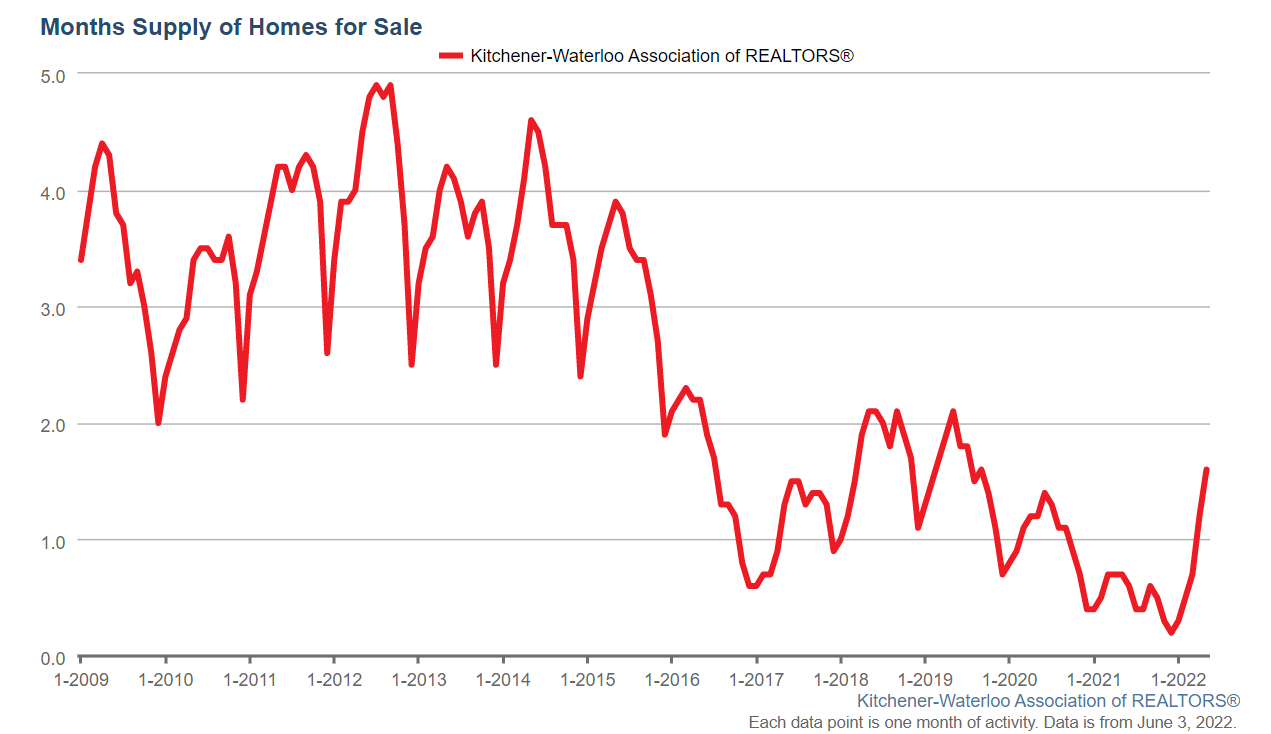

“The increase by the Bank of Canada to the key interest rate in April had the predictable result of knocking some buyers down if not out of the market in May…While the impact to prices is small, it has had a critical impact on some buyers and what they can now afford.”

M Bell, President of KWAR

May Sales Breakdown:

- 404 Detached Home Sales

- 95 Condominium Sales

- 47 Semi-Detached Home Sales

- 115 Townhouse Sales

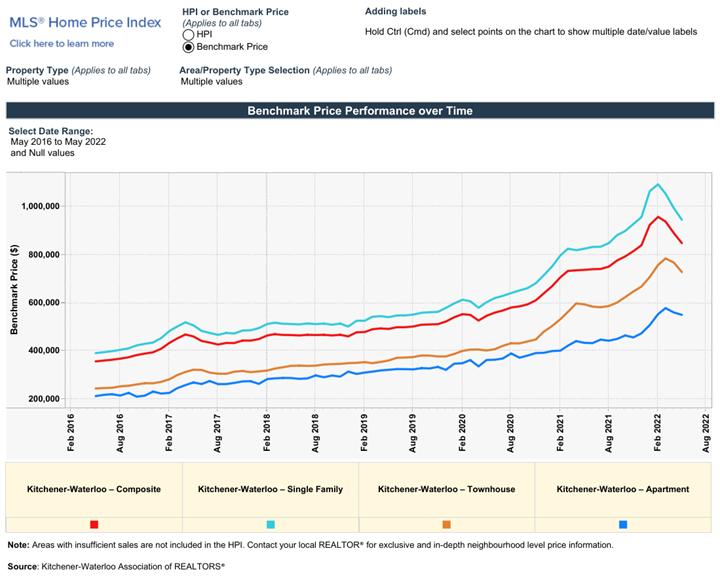

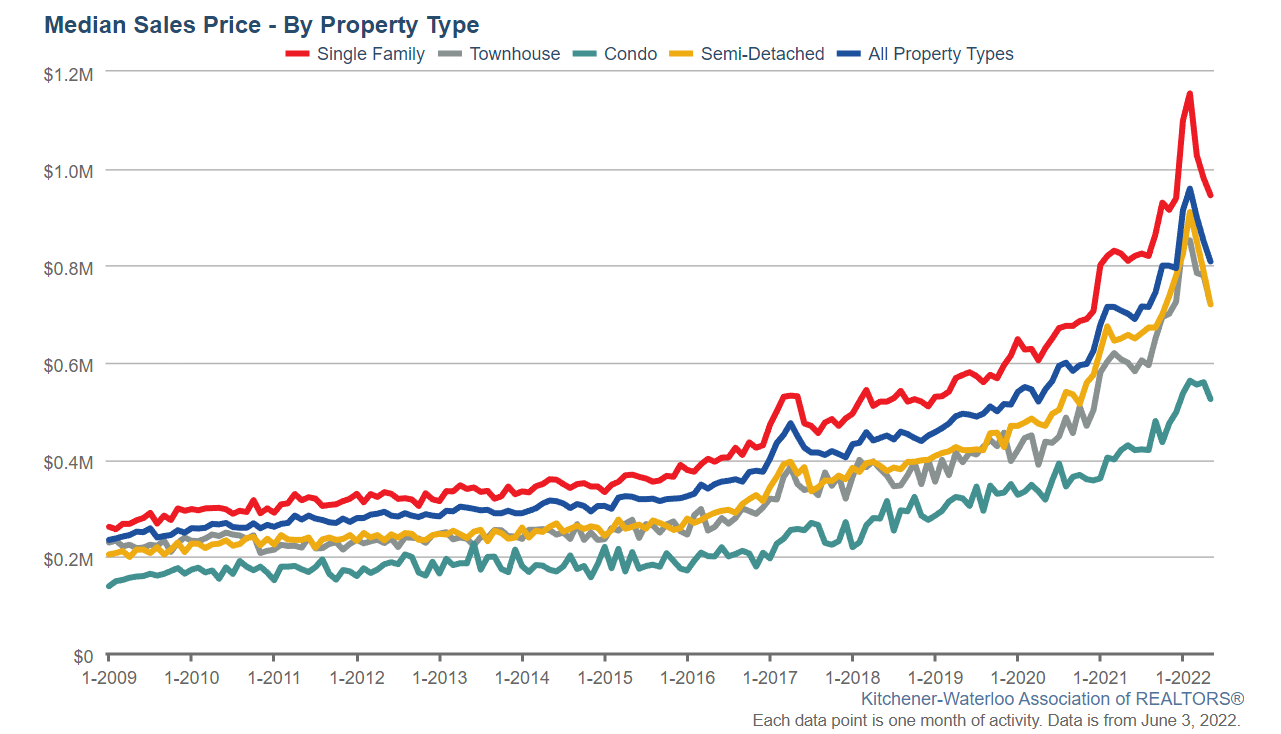

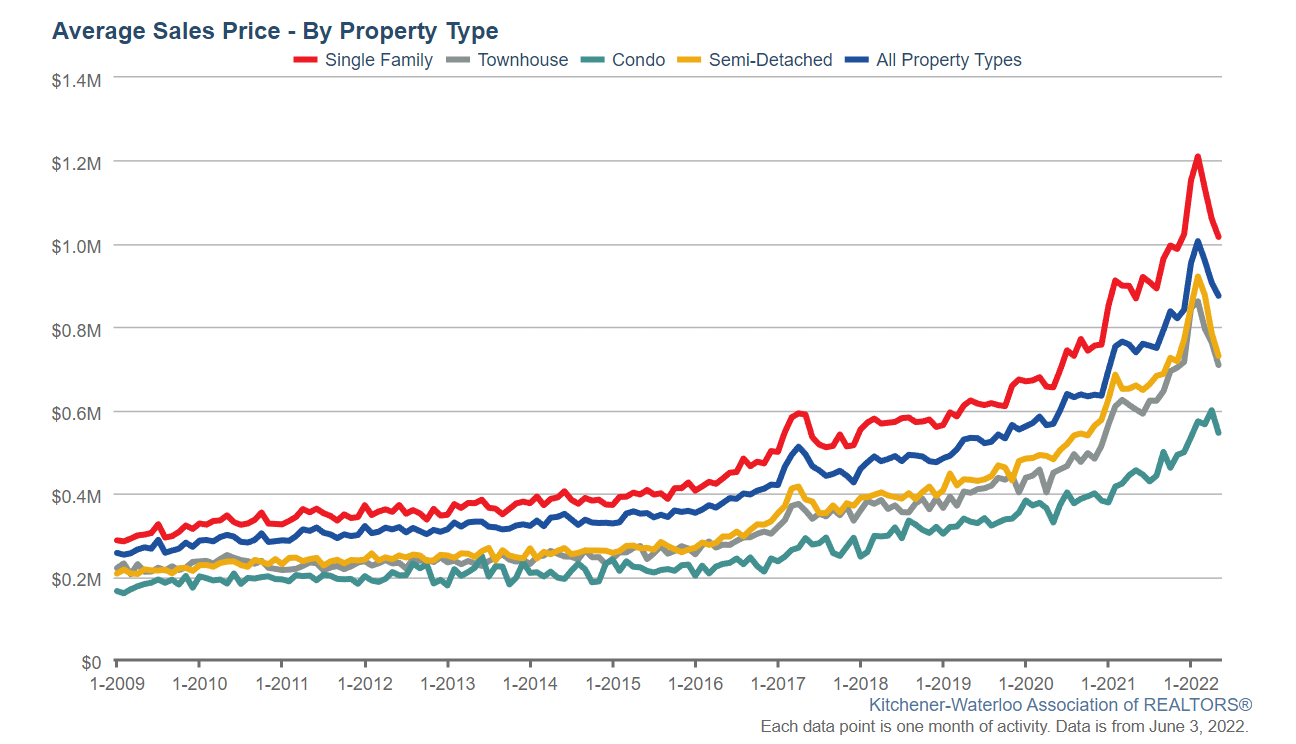

The average sale price of all residential properties sold in May is up by 18.3% to $875,194 compared to May 2021.

Average Home Price:

- $1,016,834 Detached Homes

- $545,825 Apartment-Style Condominiums

- $708,722 Townhomes

- $730,768 Semis

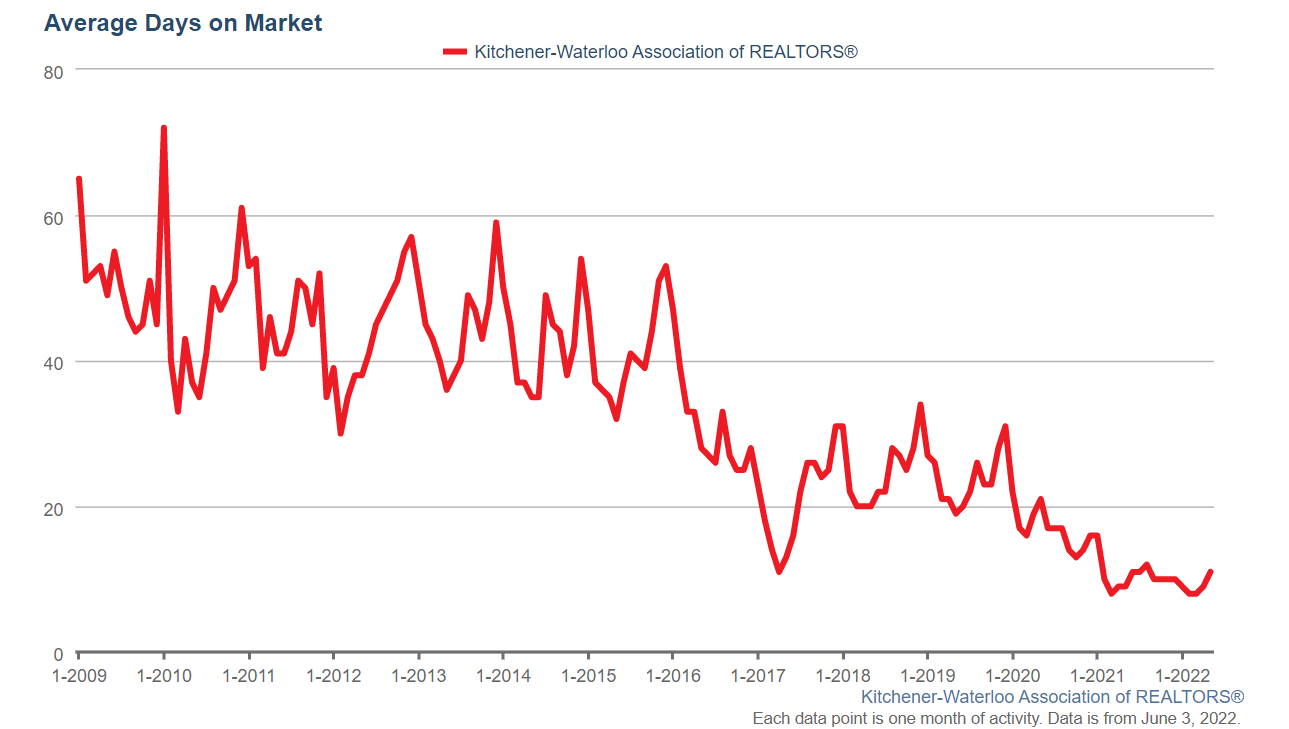

It took an average of 11 days to sell a home in May, compared to 9 days in May 2021. 902 homes were available for sale at the end of May, an increase of 98.2% compared to May of last year.

Market recap from the President of KWAR:

“With the announcement from the Bank of Canada about another interest rate hike this week we may see a resurgence of buyers who have locked in at a lesser rate, but as borrowing costs continue to increase, we should expect demand will continue to soften, particularly in the more entry-level segment of the market.”

To learn more about the market and what this means for you, connect with Suzanne.

Source: kwar.ca/category/market-updates